Key points:

- Tungsten is critical for defense, aerospace, semiconductors, and green technology.

- China dominates the global tungsten supply, controlling over 80% of the market.

- China’s recent export restrictions threaten supply chains.

- The U.S. is prioritizing securing domestic tungsten supply to reduce reliance on imports.

- American Tungsten, with its IMA Mine in Idaho, is positioned to help the U.S. meet domestic demand.

The U.S.-China trade war has disrupted the market for one of the strongest refractory metals—tungsten, a critical mineral for security and technology.

China, which produced over 80% of the world’s tungsten supply in 2023, announced export controls targeting the metal in response to an additional 10% tariff on Chinese goods implemented by U.S. President Donald Trump. This move threatens global supply chains, prompting Western nations to seek alternative sources.

The U.S., in particular, faces growing challenges in securing a reliable tungsten supply, highlighting the need for domestic production to strengthen national security and industrial competitiveness.

The Metal of Tomorrow

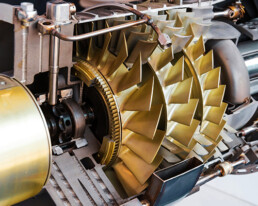

Tungsten is vital for industries ranging from defense to technology. It is used in armor-piercing ammunition, aerospace components, and even semiconductors, which are now more critical amid the U.S.-China AI arms race.

The critical metal is playing a growing role in clean energy technologies, including wind turbines and electric vehicle batteries. As industries transition toward advanced manufacturing and AI-driven technologies, securing a reliable tungsten supply has become more critical.

Tungsten in Global Security

Growing geopolitical tensions highlight the security risks of China’s dominance in the tungsten market. With export restrictions implemented by Beijing, the U.S., the EU, South Korea, and other countries are seeking alternative sources to reduce vulnerability and secure their supply of this critical mineral.

Tungsten’s crucial role in military applications, combined with rising defense budgets globally, further elevates its importance. In 2023, global military expenditure rose to almost $2.4 billion. The countries with the strongest militaries were the top four biggest defense spenders:

- United States – $916 billion

- China – $296 billion

- Russia – $109 billion

- India – $83.6 billion

With such substantial defense spending and rising global instability, ensuring a reliable tungsten supply is more critical than ever. This underscores the need for the U.S. to secure a stable, domestic tungsten source.

Why the U.S. Needs Domestic Tungsten Supply

The United States has not mined tungsten commercially since 2015, relying heavily on imports from foreign suppliers. In 2023, the U.S. imported $253 million worth of tungsten, making it the world’s largest importer. China accounted for 35.1% of these imports ($88.9 million), followed by Germany (14.8%: $37.4 million) and Canada (13.3%: $33.8 million).

As China tightens its grip on exports, the demand for a reliable U.S. tungsten supply has become increasingly important. To address this, U.S. policymakers have identified tungsten as a critical mineral for national and economic security. Given the metal’s importance in military and advanced technology applications, the U.S. Department of Defense has prioritized securing domestic supply.

On his first day in office during his second term, Trump signed Executive Orders 14154 (Unleashing American Energy) and 14159 (Declaring a National Energy Emergency) to boost critical mineral production. These presidential directives prioritize removing barriers to speed up project timelines and private investment, among other actions.

The U.S. government has also been investing in critical mineral projects, aligning with the Trump administration’s push to reduce dependency on foreign minerals and strengthen domestic supply chains.

Filling the Critical Supply Gap

As the U.S. seeks domestic solutions, American Tungsten (CSE: TUNG | OTCQB: DEMRF | FSE: RK9) is working to restart and expand its tungsten mining operations. The company’s IMA Mine in Idaho, once one of the top five tungsten producers in the U.S. during the 1950s, is positioned to restart production to help meet the growing demand.

The IMA Mine is a past-producing tungsten-molybdenum property situated on patented mining claims. Extensive exploration and drilling have confirmed its potential for small-scale tungsten production in the short term. The property is also easily accessible via nearby paved roads, offering proximity to key resources and infrastructure.

Backed by historical production data, proven mineralization, and nearby infrastructure, the IMA Tungsten Mine holds a competitive edge in the race to establish U.S. tungsten supply.

Opportunity for Tungsten Companies

As geopolitical tensions reshape global supply chains, interest in securing a reliable tungsten supply is growing across both government and private sectors. Mineral exploration companies like American Tungsten are becoming key to ensuring domestic access to this critical resource for the U.S. Investors seeking exposure to critical minerals and national security-linked resources should follow the company’s progress.

Disclaimer: The information and content provided in Global One Media’s blog are for general informational purposes only and do not constitute financial, investment, trading, legal, tax, or any other form of advice or recommendation. The content is intended solely for distribution on Global One Media’s network and is based on information available at the time of writing. Readers are strongly encouraged to seek professional financial advice before making any investment decisions.